Methods for Charitable Giving

We want to help you achieve your charitable giving while taking advantage of the tax benefits available to you.

WOASF does not intend to provide tax, legal or accounting advice. Please consult your accountant or other tax advisor before engaging in any transaction.

Retirement Accounts

REQUIRED MINIMUM DISTRIBUTIONS

- Traditional or Tax-Deferred accounts require Required Minimum Distributions (RMDs) starting at age 72 (*or earlier if distributions began prior to SECURE Act)

- These RMDs add to your taxable income (earned income, military/federal pension, capital gains from investments, social security)

- The percentage to distribute gets higher and higher the older one gets

REQUIRED MINIMUM DISTRIBUTION (RMD) EXAMPLE

Bob is an account holder age 74, whose birthday is on October 1st. Bob’s IRA is worth $410,000 now and had a balance of $400,000 on Dec. 31 of the previous year. The distribution factor from the relevant IRS table is 25.5 for age 74.

The required minimum distribution is calculated as:

RMD = $400,000 ÷ 25.5 = $15,686.27

So Bob needs to withdraw at least $15,686.27.

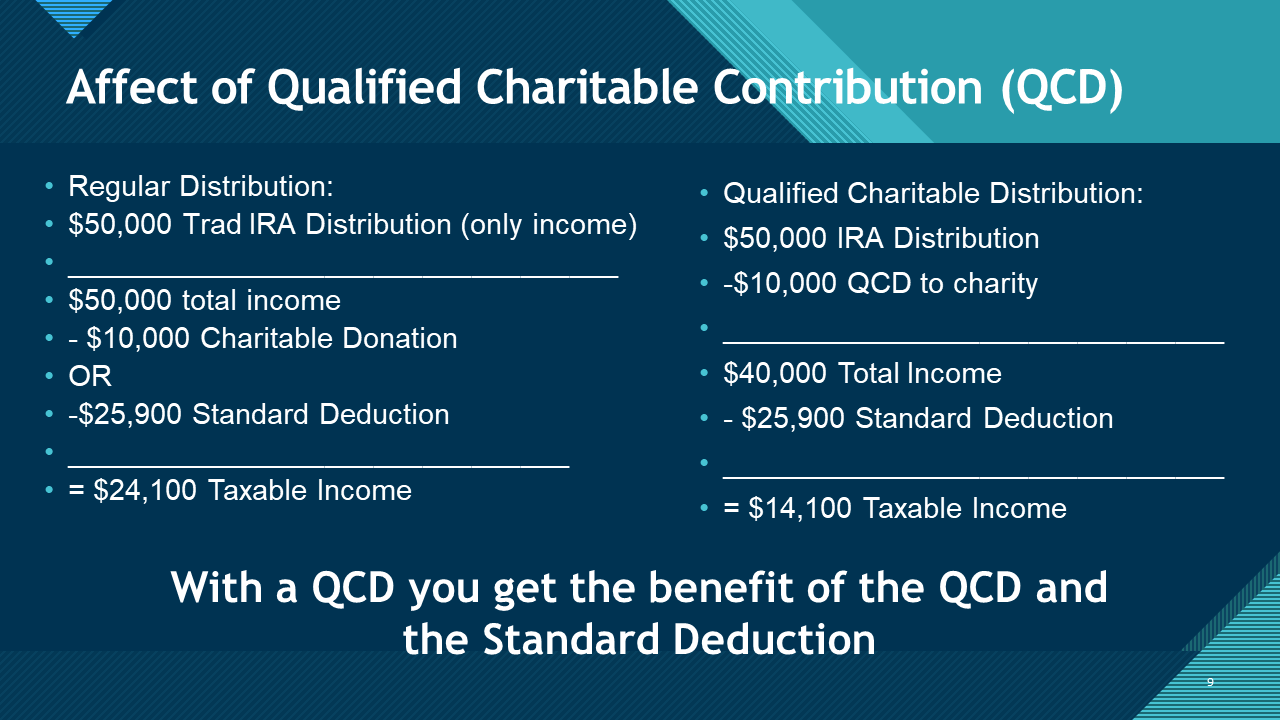

QUalified charitable distribution

(QCD)

- Donate some or all of your RMD to eligible 501(c)(3) charities and houses of worship

- Avoid paying tax on the donated amount

- Funds are transferred directly from the IRA custodian to eligible charity

- Must be at or over 70 ½

-

QCD capped at $100,000 annually per person

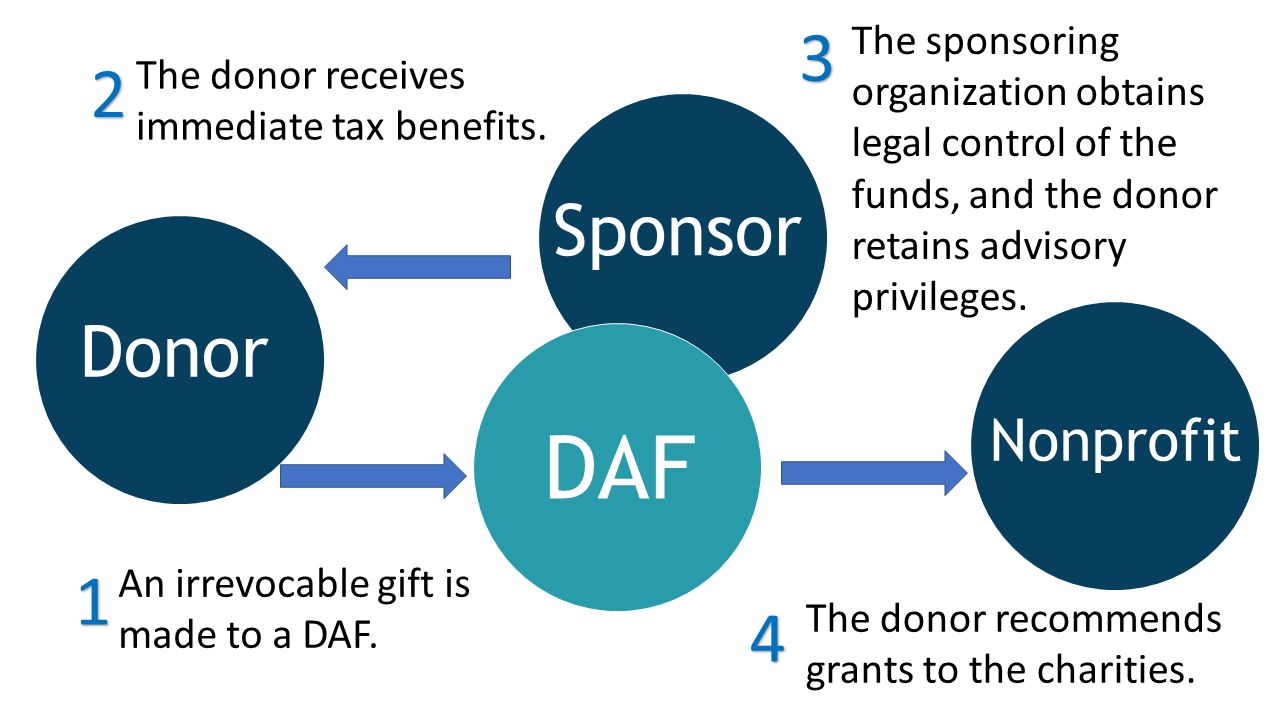

Donor Advised Fund (DAF)

- No age requirement

- A donor-advised fund is a private fund administered by a third party and created for the purpose of managing charitable donations on behalf of an organization, a family or an individual.

- Donor-advised funds are private funds for philanthropy

- Donor-advised funds offer Federal income tax deduction of up to 60% of adjusted gross income (AGI) for cash contributions and up to 30% of AGI for appreciated securities

- Donor-advised funds also accept non-cash assets, such as stocks, mutual funds, and bonds (Benefit is you can write off fair market value of the stock, which may be larger than your original cash basis and can prevent you from paying capital gains tax)

- Contributions NOT from Retirement Account, but from brokerage account

HOW IT WORKS

- Select a national donor-advised-fund organization

- Provide donation to that organization and receive IMMEDIATE tax benefit

- Choose to distribute assets from DAF to an approved charity immediately OR do it later. You retain control of WHERE the money goes, but you have given up ACCESS to the money for yourself (Donations are irrevocable)

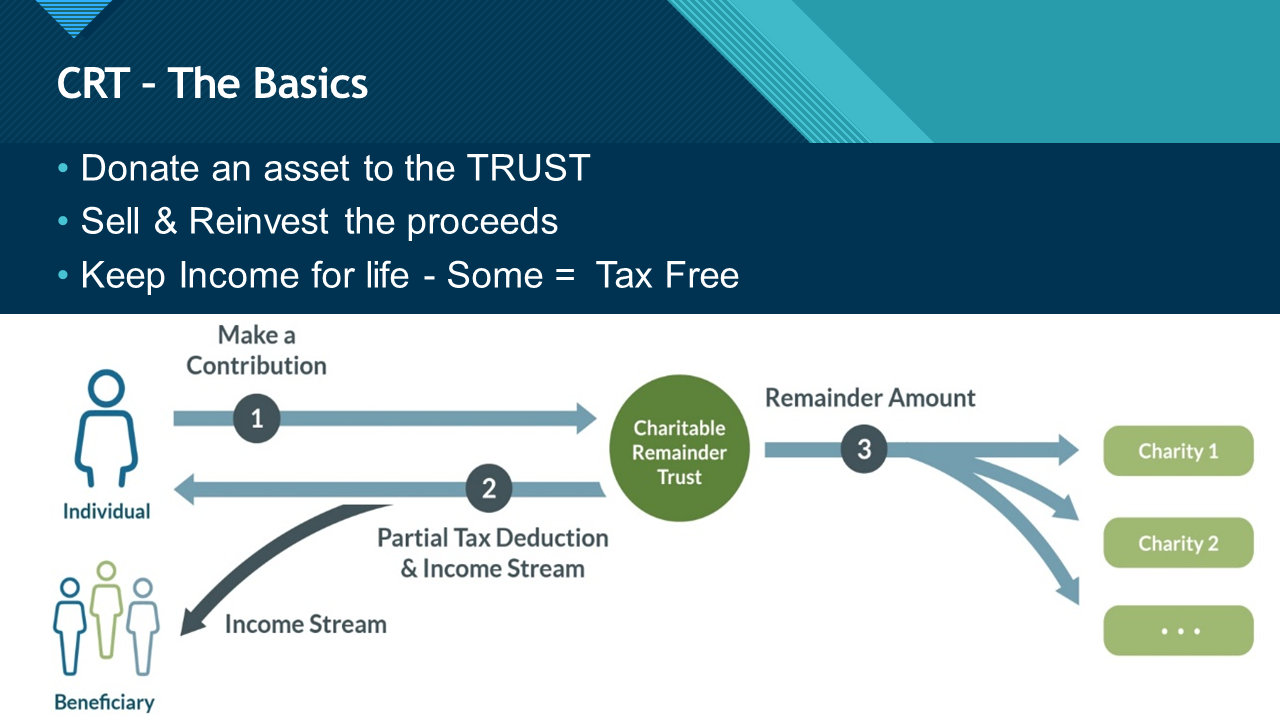

Charitable Remainder Trust (CRT)

WHAT IT IS

- Irrevocable Trust that generates a potential income stream for life

- Purpose:

-Generate income & enable donor to pursue philanthropic goals while

-Helping to provide for living expenses - Benefits:

-Flexibility & Control (some) over your intended charitable beneficiaries + lifetime income

HOW IT WORKS

- CRT is a “Split Interest” giving vehicle

- Allows you to:

-Make contributions to the trust, and

-Be eligible for partial tax deduction,

*Based on CRT’s asset that passes to the charity - TRUST BENEFICIARIES

-You (Donor) or someone else

*stream of income for a term of years - 20 maximum, or

-For life of one or more non-charity beneficiaries –

*and then name the charity as remainder beneficiary

CHARITABLE REMAINDER TRUST - STEP BY STEP

STEPS:

- Make partially tax-deductible donation

- Cash, stocks or

- Eligible to take a partial tax deduction - You or chosen beneficiaries receive an income stream

- Income of 5% - 50% of trust’s assets - After timespan / death of the last income beneficiary

- Remaining assets the charity

EXAMPLE:

Stock worth $3,000,000

Basis $100,000

Avoid Capital Gains

If sell = 20% capital gains on 2.9M

58,000 taxes pd the balance invested is 2,420,000

Invest it @ 7% = $169,400

If CRT sells stock, NO capital gains

Invest 3M @ 7% = $210,000

Net +$40,600 per year

CRT VARIATIONS

- Charitable Remainder Annuity Trust

- Charitable Remainder Unitrust

- CRT Coupled with DAF

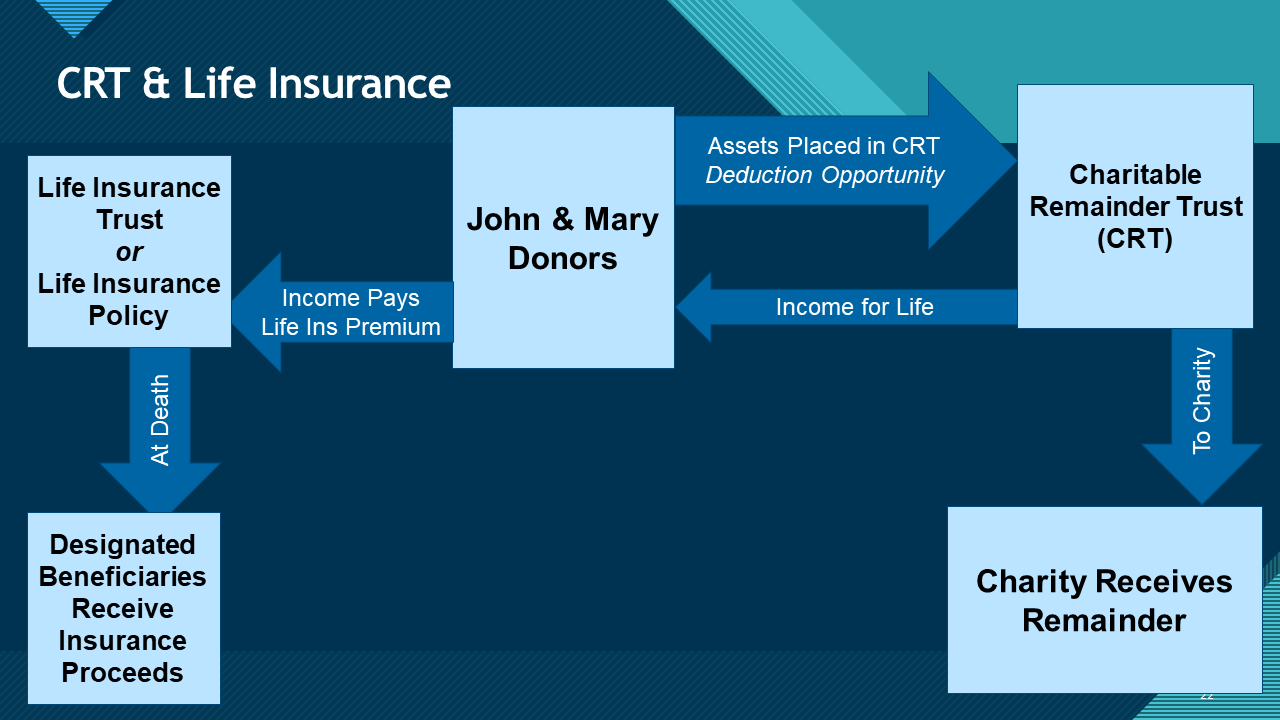

- CRT Coupled with Irrevocable Life Insurance Trust (ILIT)